WealthWiz Digital Platform

WealthWiz is a platform that encourages children to manage and save their money wisely, set financial goals and improve their financial literacy under the influence, guidance and supervision of a parent and/or guardian.

A digital financial platform designed for children to manage their savings

Platforms

Native mobile

Responsive web:

Desktop

Tablet

Mobile

Project duration

Aug. 13, 2023 - present

Tools used

Adobe Creative Cloud/Suite:

Adobe Illustrator

Adobe Photoshop

Figma

Mural

The challenge

Parents in Canada are worried about their children’s financial future because financial uncertainty and affordability are top of mind as they battle inflation and expensive costs of living in our current unsettled economic environment (*1). In our modern-day society with the ever-increasing technology devices, “72% of children under 5 years old spend an average half-hour online every day, it's no wonder more kids with home internet access know how to play a computer game or use a smartphone rather than swim, ride a bike, or tie their shoelaces (*2).” After thorough research on this topic, I was able to frame my problem statement:

“How might I design a seamless user experience that can provide hands-on experience for children, empower them to manage their money and build their financial literacy so they can successfully reach their financial goals under the influence of their parent(s) and/or guardian(s)?”

The goal

To provide a seamless and engaging experience to encourage children to budget wisely, reach their financial goals and educate them about the principles of money. Since the accounts must be shared with parents and/or legal guardians, their role is to monitor their children’s activities and influence them in a positive manner.

Measuring success (KPIs)

If WealthWiz was introduced to the market for customers to use, I would measure success based on the following:

Success task rate:

For children to easily set financial goals and share them with their parents/guardians.

For parents and/or guardians to move funds easily from their own accounts to transfer to their children's accounts.

Engagement:

To encourage both children and parents/guardians to enjoy the experience of using the product so they can achieve their goals, wants and needs.

Conversion rate and maintaining active/returning users:

After users sign up for an account, I need to ensure they are using the product on a regular basis.

User satisfaction:

If the user is satisfied with using this product, it is highly likely they would recommend it to other members of the same household. This is important because it can encourage children to collaborate with their siblings and contribute their money into a shared account. When an account is shared, it makes it easier for them to quickly achieve their goal when they want to buy an expensive product so they can put the rest of their money aside for something else.

End-users

This platform will target children and teenagers, including parents and/or legal guardians whose role is to supervise and influence them in the right direction of meeting their financial goals.

My Role and Process

Since WealthWiz is an ongoing passion project, I am currently leading the experience design, conducting user research, defining requirements and content management and designing the interaction and UI/visual designs of this platform.

1 - Discover

Problem statement validation through online research

I needed to understand where local Canadians stands in financial literacy today, especially in our challenging economic climate. Also, I was curious about how parents nationwide feel about money and what they hope to teach their children about financial literacy. Here’s what I found based on a survey conducted in collaboration with Mydoh and Leger with 1,500 parents of children aged 6-18 across Canada (*3):

Basic money management is the main skill parents hope their children will learn before reaching adulthood.

9-in-10 parents of children aged 6-18 say that basic money management is an important life skill they hope their children develop before reaching adulthood.

39% of parents say this is the number one life skill they want their children to learn before reaching adulthood.

9-in-10 parents say their children are more familiar with basic financial terms (ex: credit and debit) than sophisticated financial terms (ex: exchange rate and credit score).

Instilling children with the financial literacy and skills needed to be able to support themselves in adulthood is a top priority for many parents.

9-in-10 parents are confident their children will have the skills they need to be financially independent in their lifetime.

Over 50% of parents currently trust their kids to manage their money on their own.

Almost 70% of parents aren’t optimistic about their children’s finances as they worry about their children’s ability to make large purchases (ie: weddings, celebratory events, car) in the future.

Nearly all parents agree the next generation needs to be fluent in financial literacy

Over 75% of parents strongly agree that children should have basic knowledge of saving, paying bills, taxes, managing a budget etc.

Over 90% of both parents agree they should be on the same page about how to teach children about money management and earning or saving money.

Many parents rarely discuss with their children about their personal or home finances, as less than 30% responded that they have these discussions weekly. It’s probably because many felt their parents weren’t proactive enough in teaching them about money and budgeting.

Nearly 70% wish they’d learned more about finances from their parents.

61% Became more motivated to learn money management when they had children.

46% Feel the need to unlearn unhealthy money management habits before teaching their own children.

62% Feel their mental health has been impacted by their financial situation or financial decisions.

46% Are often regretful over what they spend their money on.

*The findings above are from a survey conducted in collaboration with Mydoh (RBC) and Leger with 1,500 parents of kids aged 6-18 across Canada (except for Quebec).

Summarizing my online research through compelling customer journey mapping

Since my end-users are children and adults, working on customer journey maps for each user allowed me to deeply explore their nuanced habits, behaviours, needs, pain points and opportunities. Having journey maps for 2 different personas gave me a better understanding of how these different users will interact with each other using the platform, as they allowed me to define and prioritize the features of WealthWiz.

Customer journey (Child): Sarah, The early starter

Customer journey map (Adult): Adam, the experienced Financial Advisor and proud father

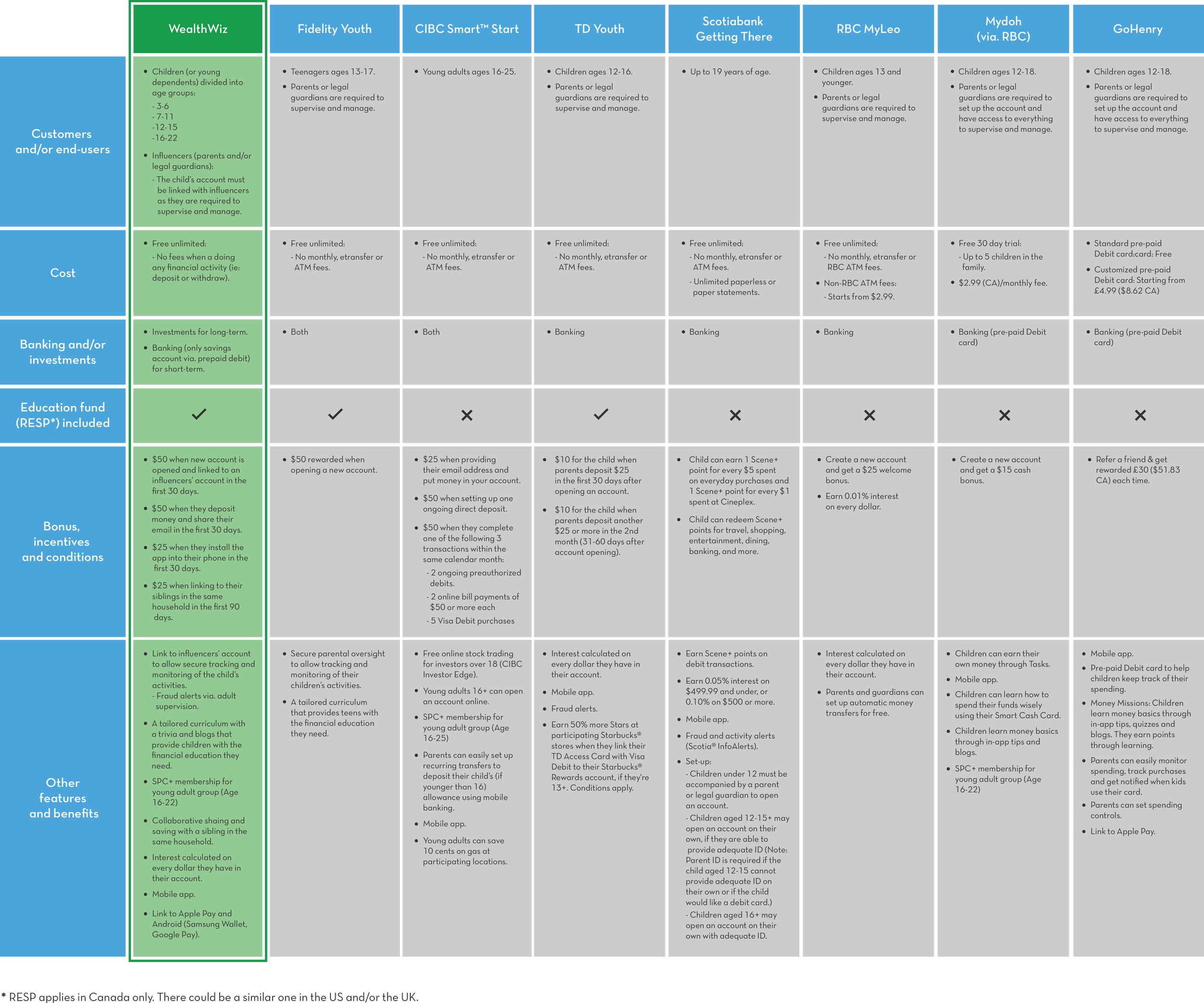

Gathering insights about my competitors for inspiration

A competitor analysis report about their products was necessary for me to identify similar user needs to potentially solve the problem and define the features of the platform.

Competitor analysis

2 - Define

Research insights that helped me define the desired features and prioritize based on my users’ wants and needs

After using the bulls-eye diagram and business model canvas methods (see below), I was able to define and my project scope with these prioritized features:

Children can set their owns goals, such as saving up short-term for a specific item they want to buy, and for some, to build and grow their savings long-term.

A points and rewards system that engage children and encourage the importance of earning money, spending wisely, saving, (and for some giving back) and practicing good behaviour (i.e.: housework or good grades at school).

Task-based activities where children can earn money and points and learn the value of money to build good life skills/habits.

Interactive lessons and quizzes can encourage children to learn, while earning points to accumulate based on monetary rewards.

Reactions/emojis to encourage motivation and engagement.

Get siblings in the same household to share an investment account and contribute a small amount on something expensive.

Spend control features are set for parents and/or guardians so they can receive real-time updates on the child’s activities.

Interactive financial glossary for children to refer to when needed.

Parents and/or guardians can open long-term investments on behalf of the child where they can have their savings be compounded annually with a built-in calculator. Investments, such as an RESP or TFSA (i.e.: nest egg, car, buying a home), can build transparency with the child and the parent and/or guardian for a better future.

Prioritizing the desired features with a bulls-eye diagram

Using my findings based on the competitor analysis and statistics mentioned above inspired me to think of all the ideas possible for WealthWiz. However, I needed to recognize what matters most to my users and aim for that as it was my goal. Therefore, I felt it was necessary to work on this bulls-eye diagram as it allowed me to prioritize and only focus on the essentials for my end-users.

Bulls-eye diagram

Narrowing down my prioritized features from the bulls-eye diagram into a business model canvas

Using the key learnings gathered from my research, as well as defining the requirements and prioritizing them, gave me the opportunity to take my concept to the next level. I used these to visualize and communicate my concept through this business model canvas:

Business model canvas

Storyboarding helped me ideate new and alternative solutions for post MVP

As an added bonus, I decided to illustrate a storyboard because it helped me visualize alternative ideas along the way. I incorporated a trivia as a potential feature to further help children improve their financial literacy as they can save their funds over time while earning points and monetary rewards. This added feature will be determined after I can gather feedback from end-users during the post MVP or validation stages.

Storyboard

3 - Design

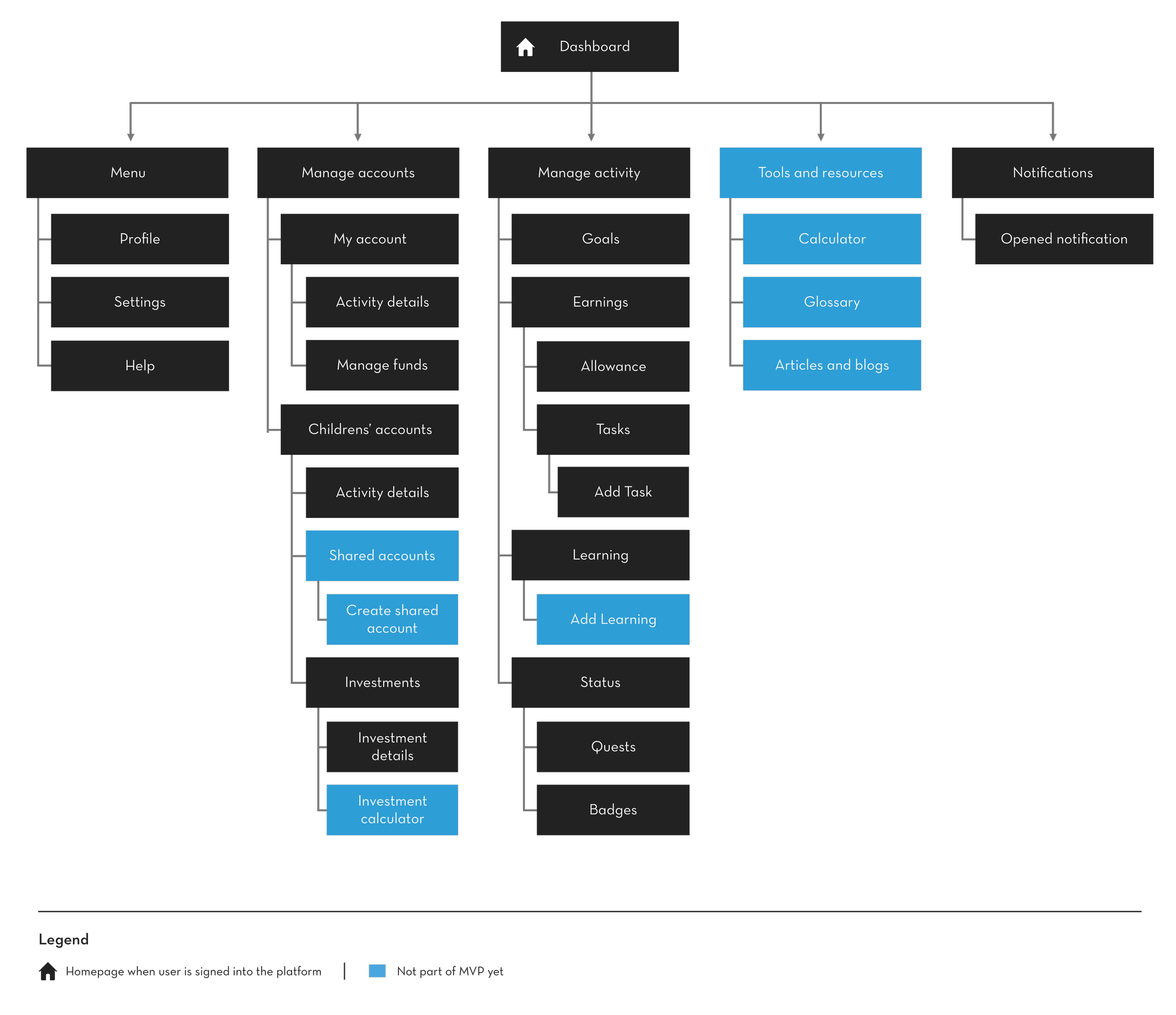

Using the prioritized features and requirements into laying out the information architecture

After defining the features and the value proposition for WealthWiz, I decided to work on this site map. This site map not only helped me lay out the foundation of the features and content of this platform but also allowed me to see how my end-users can navigate to the appropriate places based on their goals.

Site map: When a parent and/or guardian accesses the platform through the browser

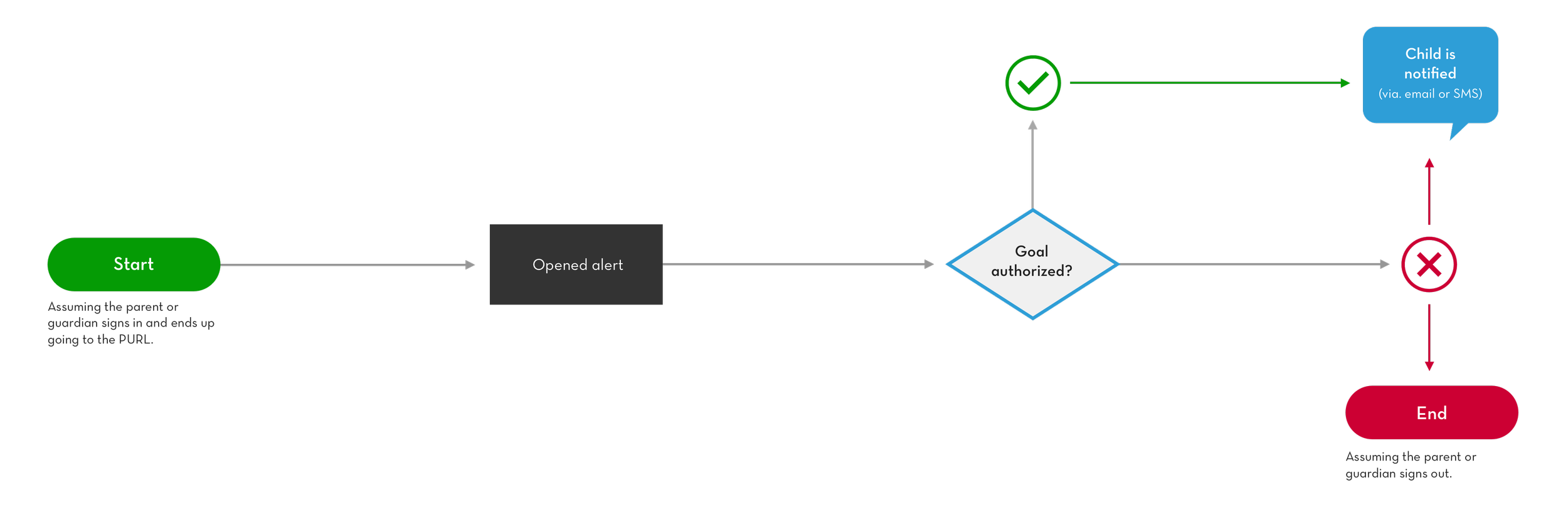

User flow mapping helped me identify how end users can interact with the platform

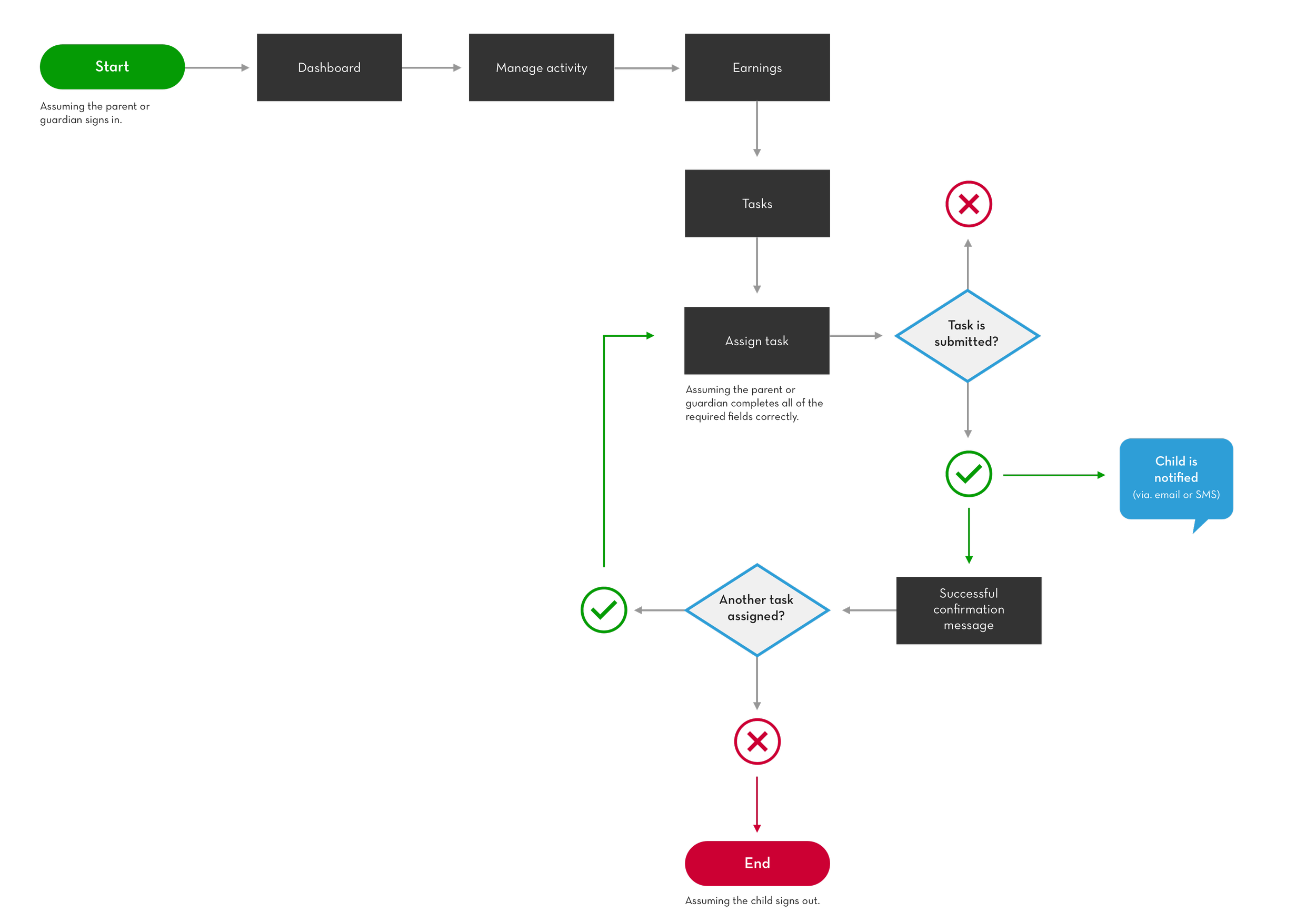

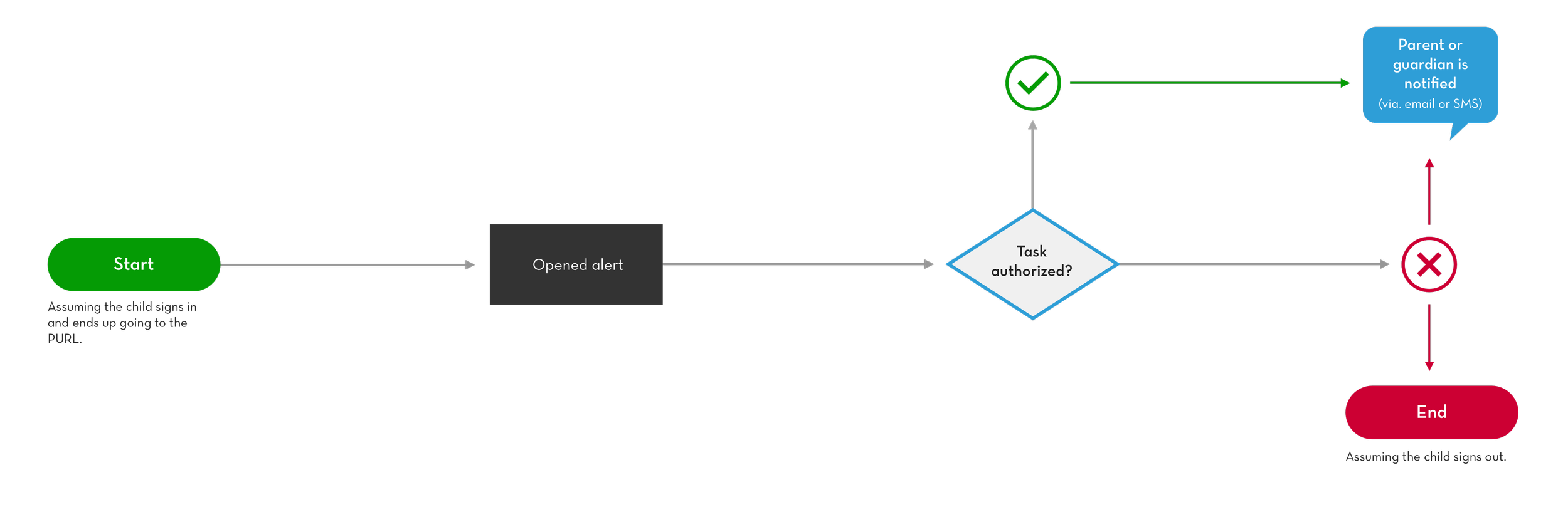

On top of a site map, I decided to map out user flows to illustrate user scenarios of how children and influencers can seamlessly interact with the platform. The following are examples of complex scenarios that required me to think critically and logically.

Setting goals: where the child sets a goal to get approval by their parent or guardian

Assigning tasks: where a parent and/or guardian assigns a household task to a child of meeting a certain deadline so they can get paid once a task is completed.

User flow: Setting goals

Child side

Adult side

User flow: Assigning tasks

Adult side

Child side

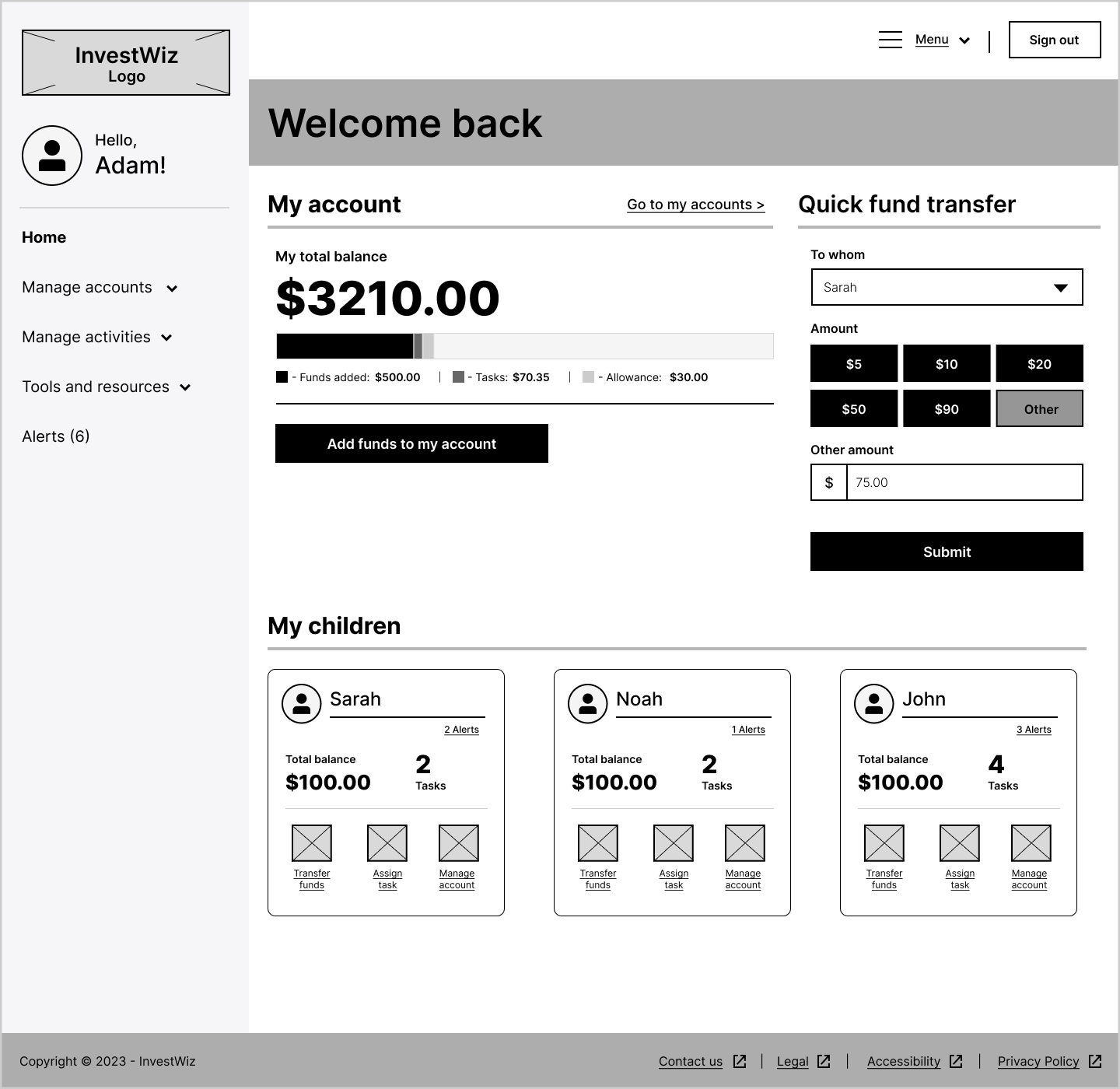

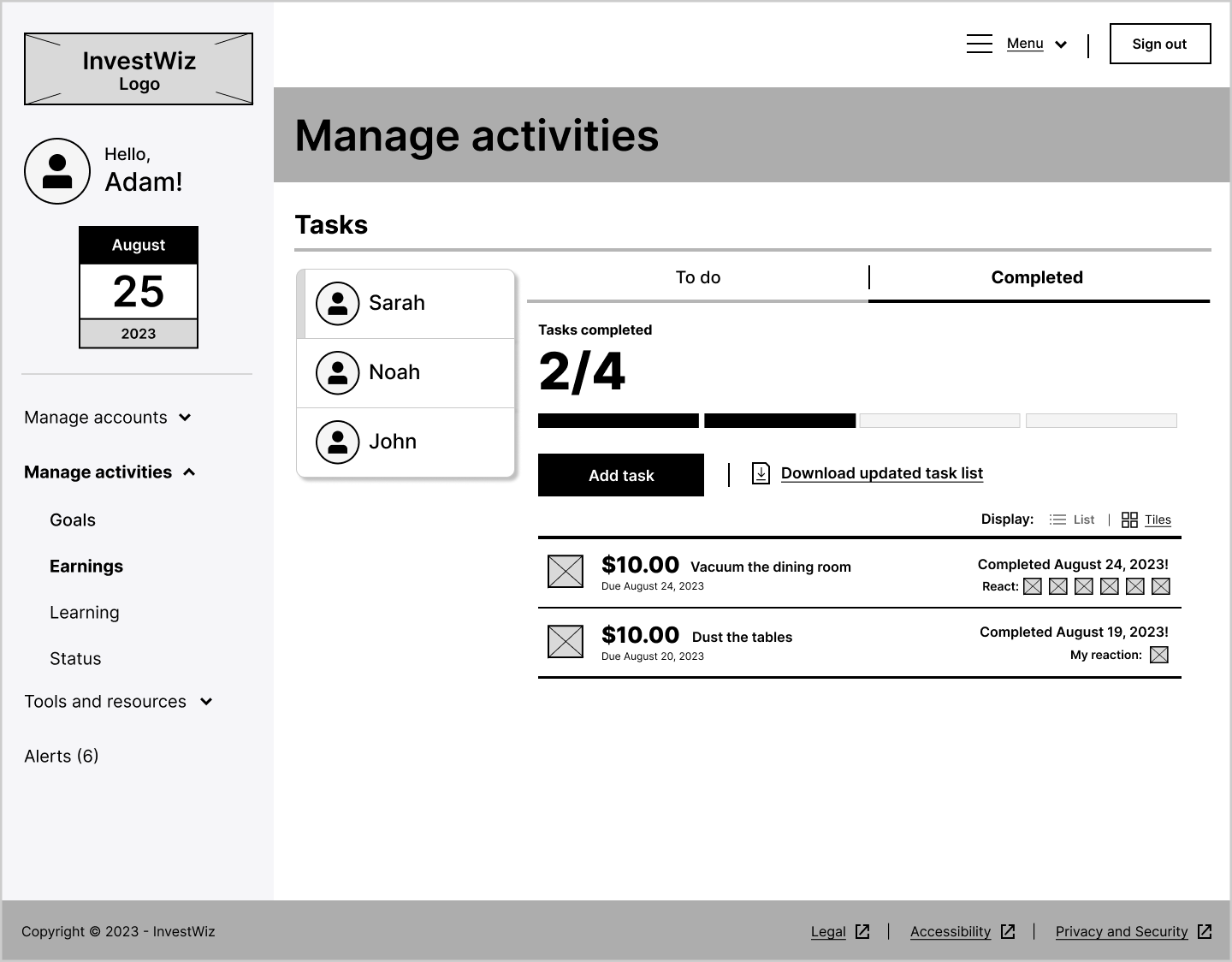

Using my site maps and user flows to design the low-fidelity wireframes

Having a comprehensive business model, including a defined site map and user flow diagram, allowed me to bring my ideas to life with low-fidelity wireframes. The rough designs illustrated my solution to the problem at a high-level. If I noticed any pain-points, then I can rework my wireframes. This approach allowed me to spend less time designing the high-fidelity prototypes at an MVP level.

Wireframes: Child side

1.0 - My money

The user checks their account balance

1.1 - My account

The user checks their savings and spending.

2.0 - My current goals

The user views their current and achieved goals.

2.1.0 - Set new goal: Defining goal

The user fills all fields for naming the goal.

2.1.1 - Set new goal: Amount

The user includes the amount with taxes.

4.0 - My Earnings

The user checks all of the potential earnings, such as allowance and tasks.

4.1 - My Earnings: Tasks

The user can view the remaining and completed tasks.

5.0 - My Learning

The user views all of the remaining and completed learning activities.

3.0 - My status

The user can view their badges and can tab to their quests and points earned.

Parent/guardian side

1.0 - Homescreen

After the user signs into the platform, the user lands into their dashboard to view their account activity, quickly transfer funds to their children and view their childrens’ accounts at a high level.

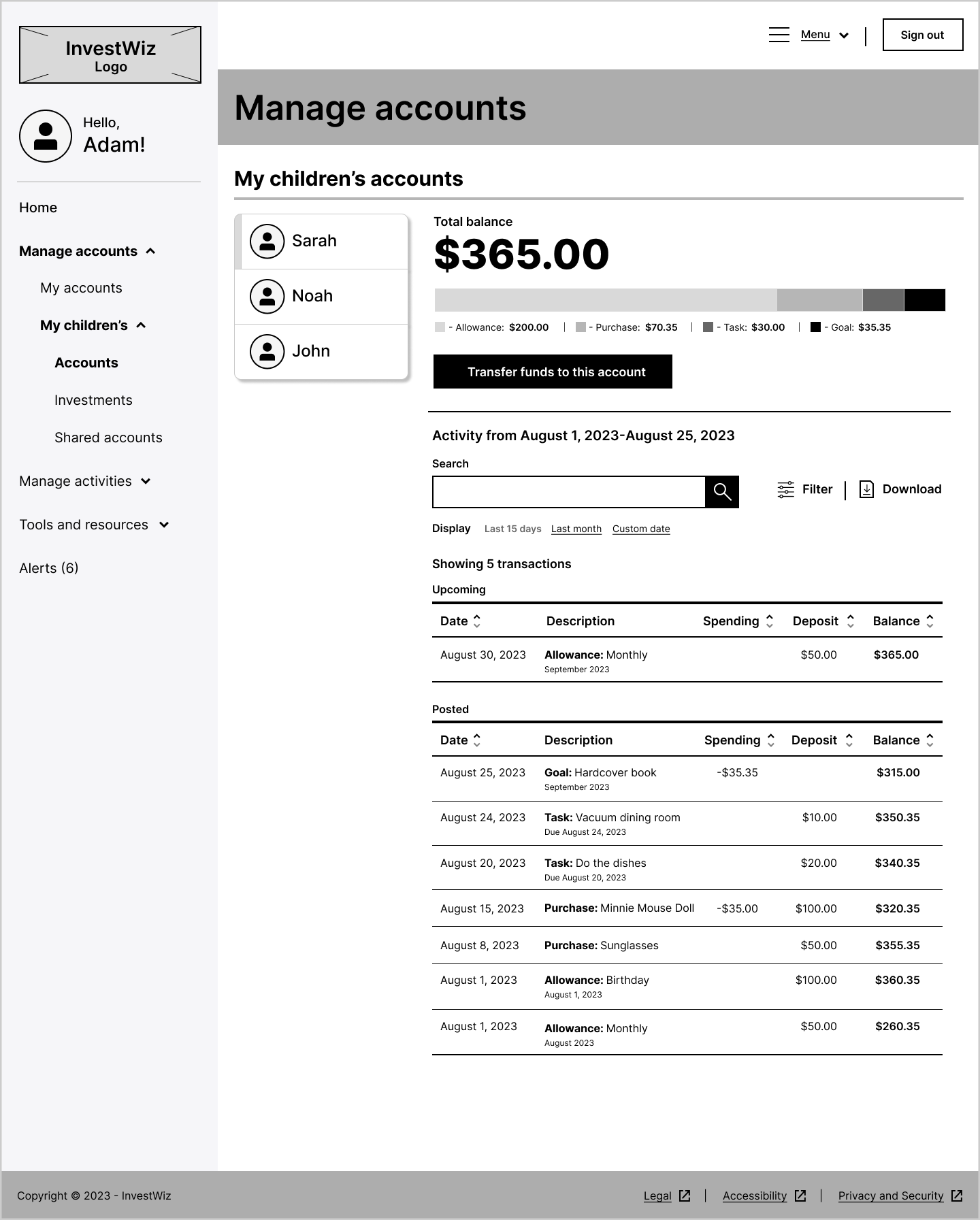

2.0 - Manage accounts: My activity

The user can check their children’s account activity. They also have a choice to go to Fund activity, which the user can add funds to their account or send funds to their children.

2.1 - Manage accounts: My children’s accounts

The user checks their children’s account activity. Also, they can transfer funds into their child’s account or download a PDF document of their activities for recordkeeping.

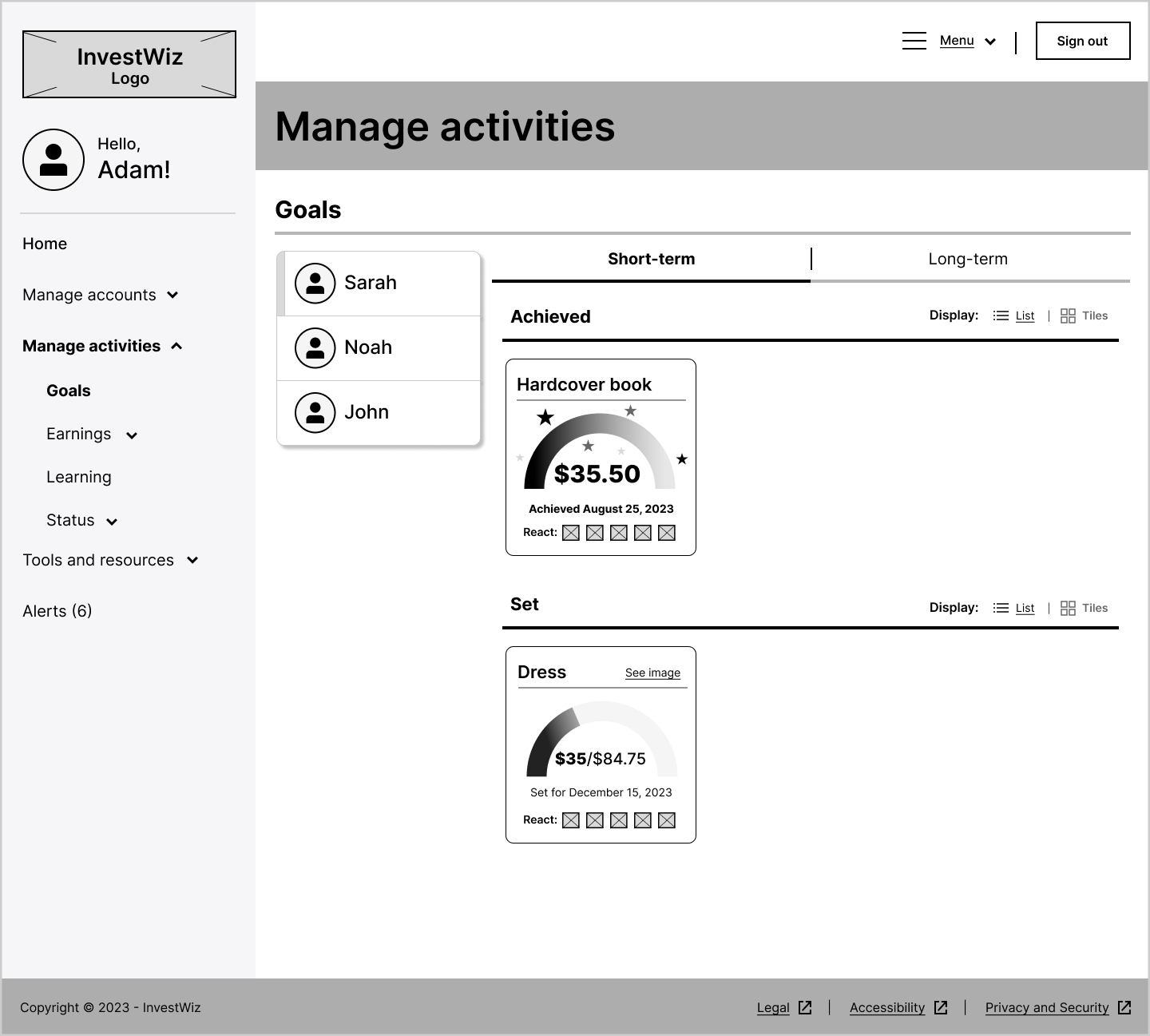

3.0 - Manage activities: Goals

The user views their children’s progress of their set & achieve goals. They can tab through the short and long-term ones. Also, they can display their view as tiles or as a list.

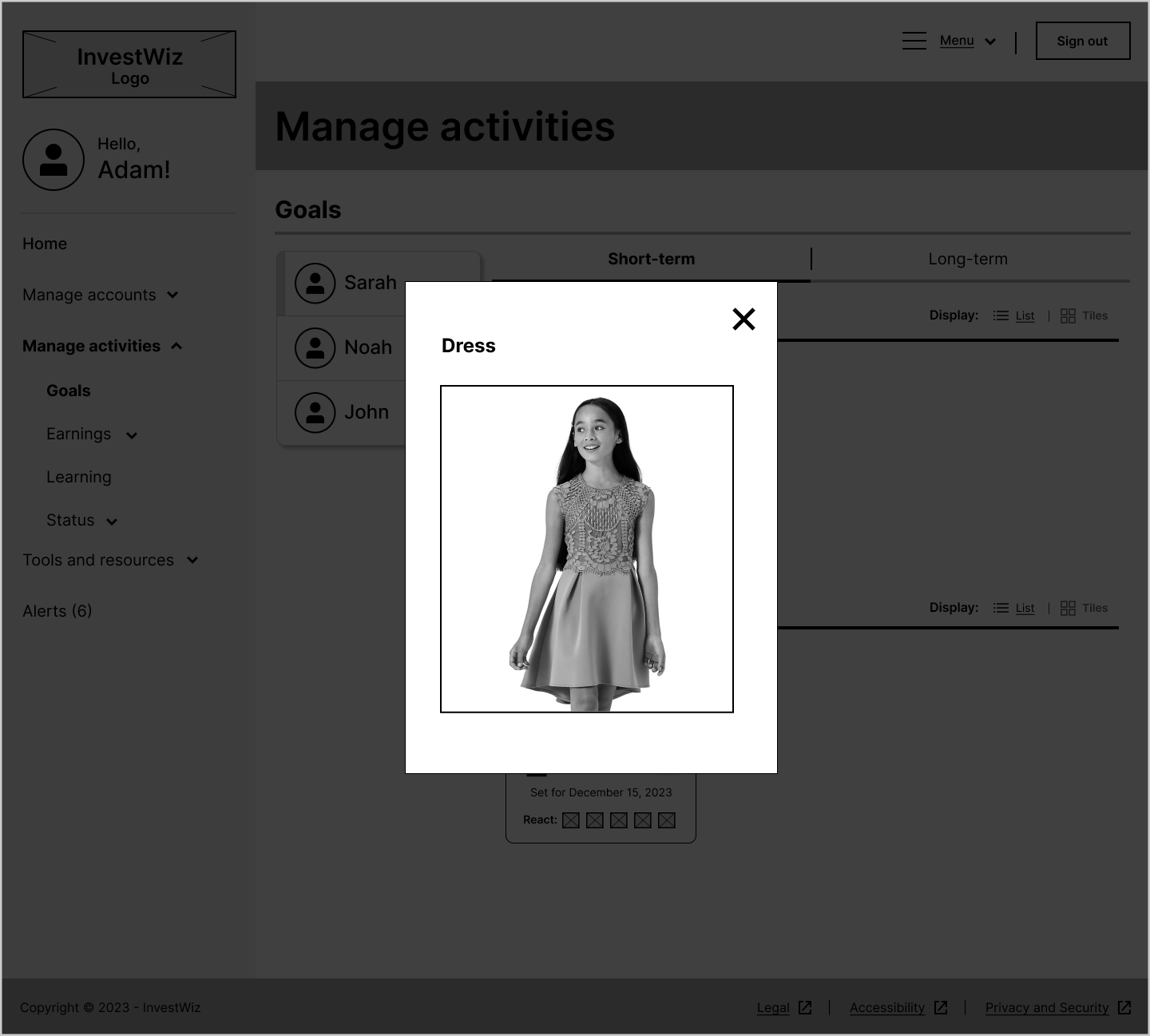

3.0.1 - Manage activities: Goal viewed

The user can view the image as it allows them to consent to their child’s goal and builds transparency for the adult to support the child to achieve the desired goal.

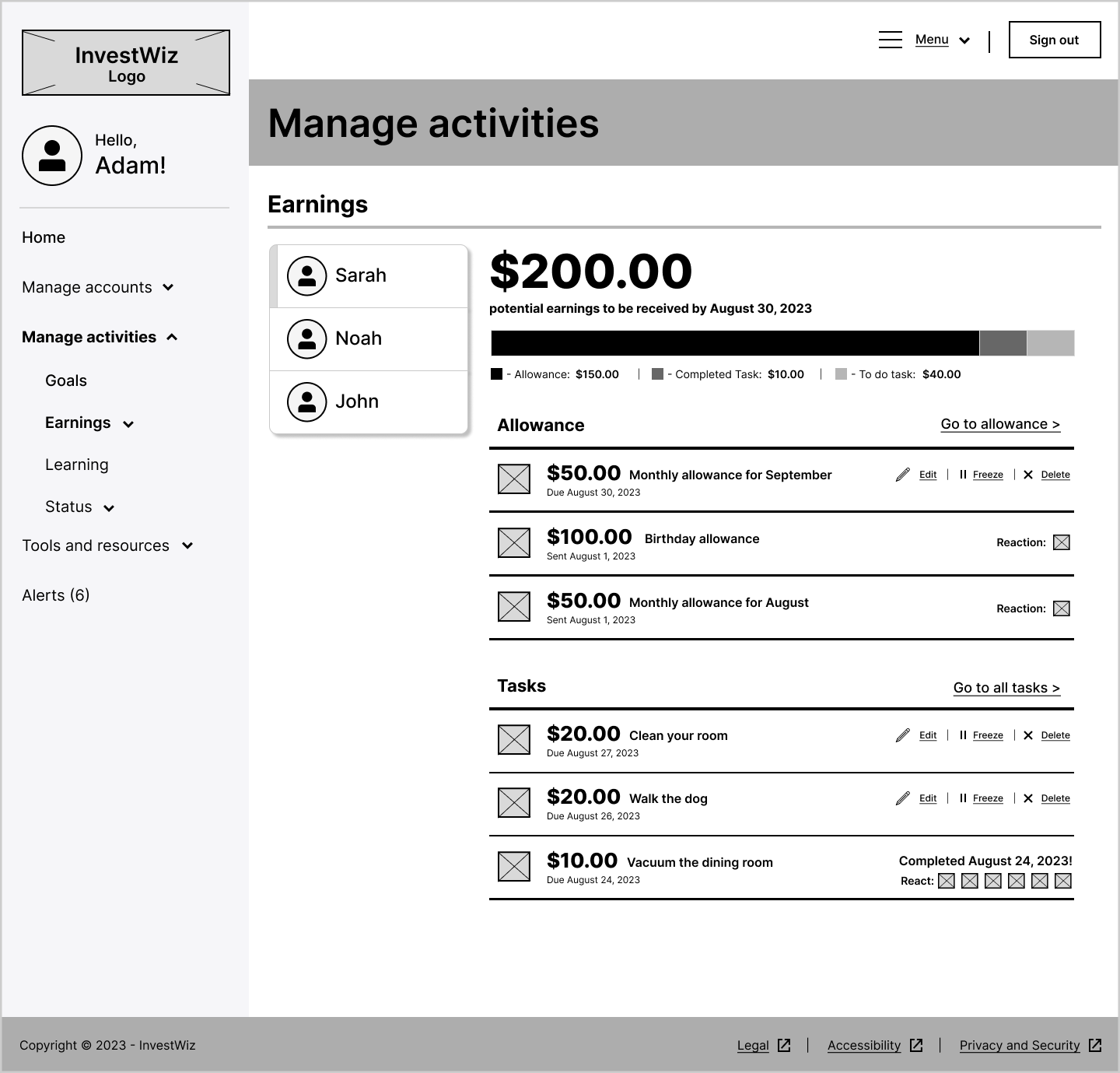

3.2.0 - Manage activities: Earnings

The user views their child’s earnings, such as allowance and tasks. They have the ability to edit, hold or delete their allowance or tasks. Also, reactions are there to foster positive sentiments.

3.2.1 - Manage activities: Earnings (Tasks)

The user views their children’s “Completed” and “To do” tasks through tabbing. They can simply add a new task, edit an existing one or react to a completed one.

3.1 - Manage activities: Status

The user views their child’s earned badges. Also, they can tab through their quests and points to know the activities their child achieved so far to meet the requirement of earning a badge.

4.0 - Alerts

The user accesses all of the received alerts to respond to their children’s requests and activities (i.e.: goal setting/completion, quests and badges achieved, milestones, etc.)

Using my wireframes to design the look and feel of WealthWiz

I used the design deliverables above to create these high-fidelity prototypes in Figma. Having to modify most of my changes in the wireframes above required very minimal effort in designing the high-fidelity mockups . I believe the benefits of having these interactive high-fidelity prototypes will help me validate my concept upon testing with end users.

If anyone interested in exploring these experiences further, feel free to access the Child prototype (native) or Adult prototype (desktop browser).

Demo: Child’s side (Native mobile)

Demo: Adult’s side (Desktop browser)

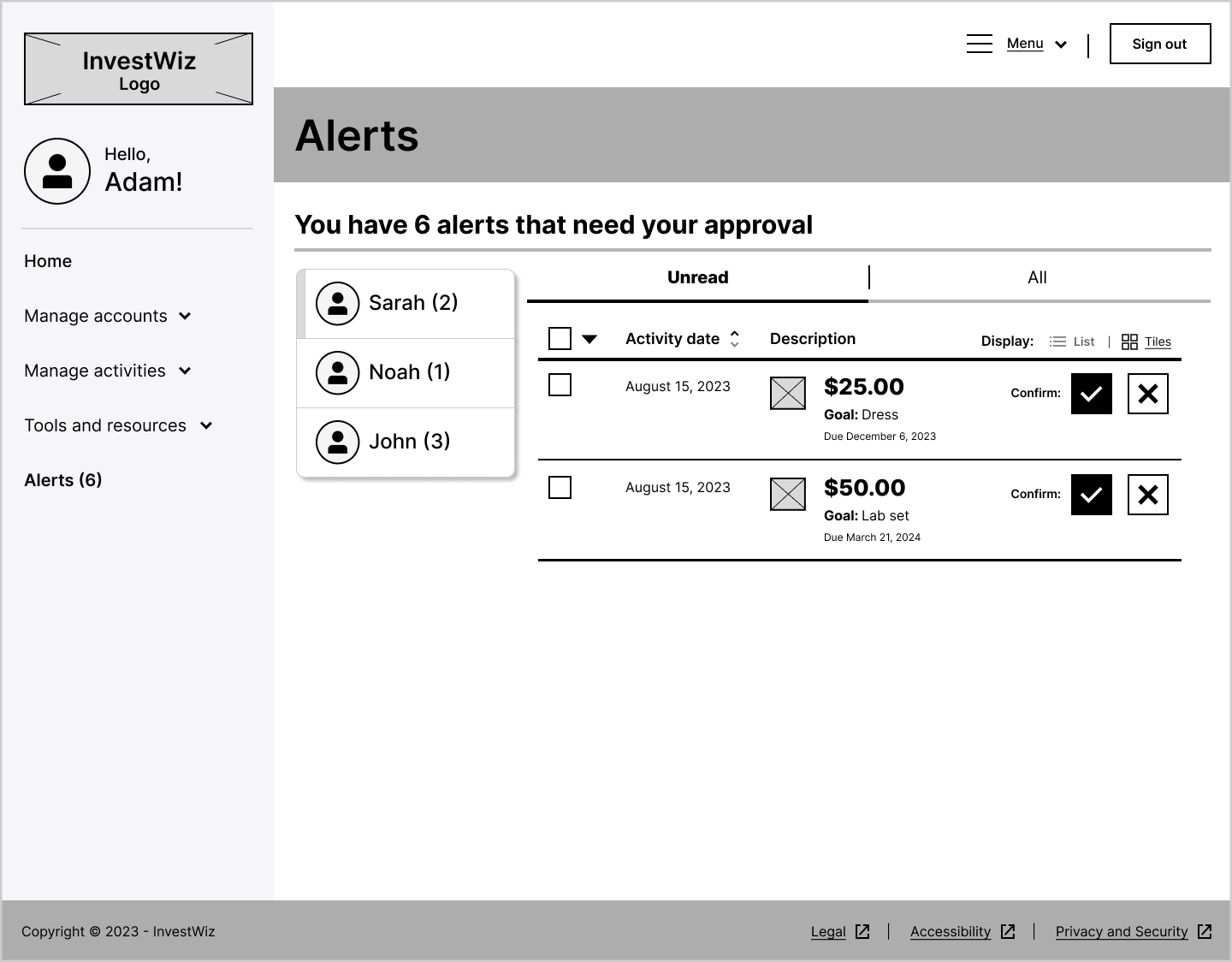

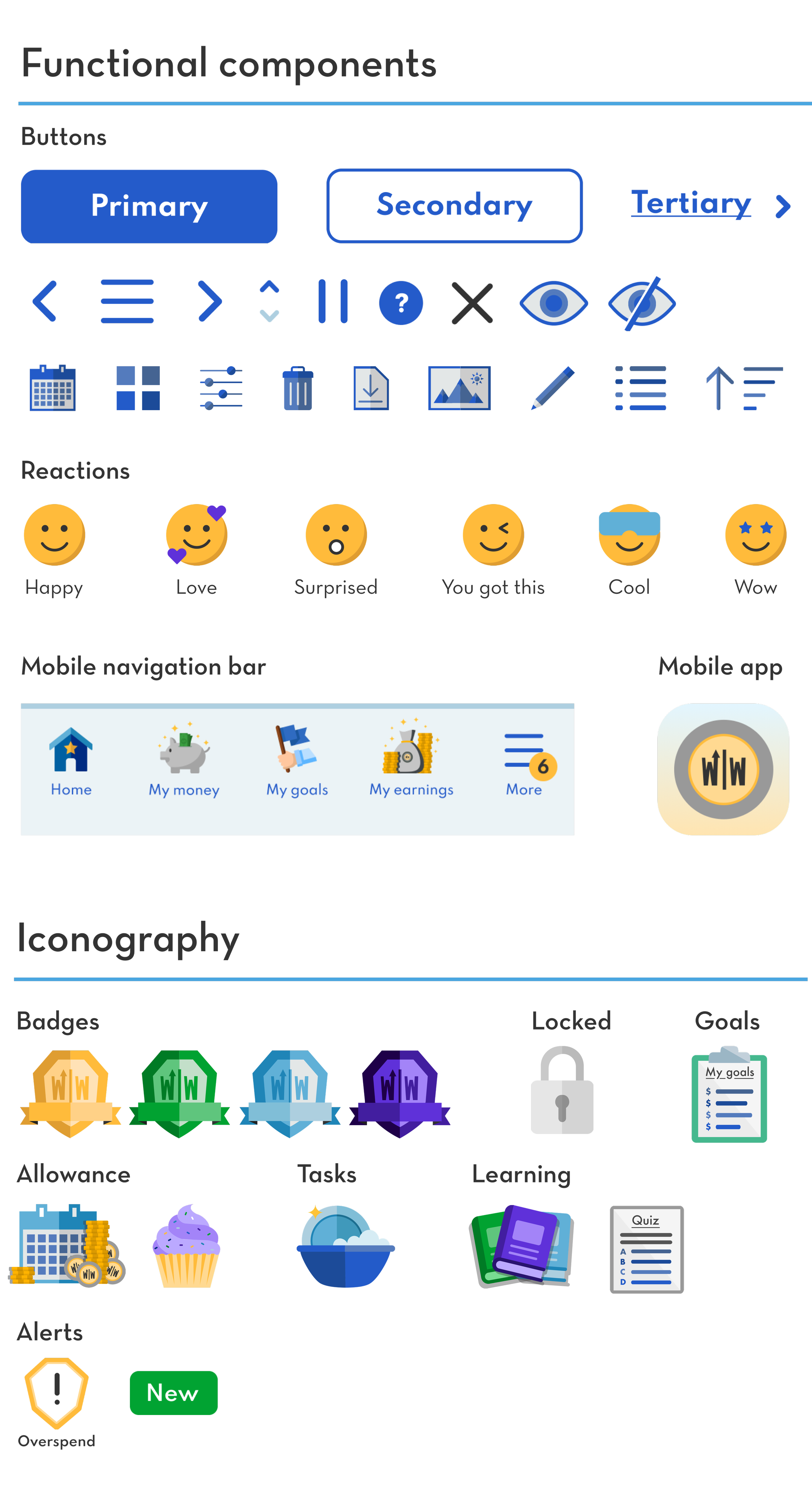

Conceptualizing the visual branding identity and designs

When I thought about the name and identity of this product, I wanted to keep it simple and playful because it mostly targets children. Growth (wealth/investments/savings/growth: upward arrow) and fiction (wizards and magical characters) were the main attributes I conceptualized and defined for the visual branding. While encouraging the significance of earning money, spending wisely and saving (and for some audiences, giving back), I wanted to make this subject matter engaging by adding delight for positive reinforcement and motivation.

I used these colours (gold for wealth and blue for loyalty), iconography, typography and interactive UI elements to convey my visual message. So, I incorporated them when I mocked up my high-fidelity prototypes (above).

Visual designs: Branding, UI functional components, iconography, messages, labels, text fields, and dropdowns

My key takeaways from this experience overall

I was motivated to work on this passion project for two reasons. First, my ideas and solutions were drawn from the relevant design projects from TVO and Manulife due to their targeted users/customers, products and services. Second, I wanted to successfully demonstrate my capabilities and understanding of applying the human centered design framework using some of the methods obtained from my LUMA training and academic experience. The biggest takeaway was that I felt challenged in a way that I used my knowledge and creativity to innovate and solve the needs of my end-users of building and improving their financial literacy so they can effectively manage their money in today’s uncertain economic environment.

My next steps: MVP and beyond

The future steps of this project involve fine-tuning this preliminary prototype upon the validation stage and beyond. If time and budget permit, I will find and recruit participants to conduct usability testing with this prototype. Validating my assumptions and guesswork with constructive feedback can help me improve the efficacy of this product with new and innovative ideas that I can take away and continuously iterate before pitching it publicly.

Resources:

TD Financial Group: Nearly 3 in 5 Canadian parents frequently worry about their children's financial future, new TD survey reveals

MyDoh: Financial literacy survey: How Canadian parents feel about money

Million Dollar Journey: Investing on behalf of children

PC Magazine: Infographic: How tech-savvy are kids?

Visionspire.ca: The Shocking Truth about Financial Literacy in Canada

Financial Post: While Canadian provinces start financial literacy programs in schools, trends among kids show there's still work to be done

Fidelity: Investing basics for teens